Web3.0 Applications - Intro to Cryptocurrencies Pt 2

Cryptocurrencies for Payments

Hi friend. How has your week been? Mine has been a mixed one. The cryptos crashed! Big time! All the tokens from Bitcoin to Litecoin, Chainlink to Terra Classic. All have been crumpling down all week due to a collapse of a major Crypto exchange. We will get back to this later.

This week, we are continuing with our analysis of use cases of cryptocurrencies. One of such is as a means of payment or enabling money transfers. Money transfer is an important part of our everyday lives and this has taken different forms and majorly handled by centralized entities like banks and third party agents like Western Union, Moneygram etc. As I mentioned last week, Bitcoin being the first and most popular cryptocoin is best used as a payment or settlement utility especially on a peer to peer basis. So today, I will take a closer look at Bitcoin and a few others that also serve as payment enabler.

This week, we are continuing with our analysis of use cases of cryptocurrencies. One of such is as a means of payment or enabling money transfers. Money transfer is an important part of our everyday lives and this has taken different forms and majorly handled by centralized entities like banks and third party agents like Western Union, Moneygram etc. As I mentioned last week, Bitcoin being the first and most popular cryptocoin is best used as a payment or settlement utility especially on a peer to peer basis. So today, I will take a closer look at Bitcoin and a few others that also serve as payment enabler.

- Bitcoin(BTC) - This formidable cryptocurrency was launched in January 2009 by an anonymous person (or group of people) known as Satoshi Nakamoto. Nakamoto mined the first block on the Bitcoin network known as the genesis block, thus launching the world's first cryptocurrency. However its first commercial transaction had to wait till May 22, 2010 when a programmer traded 10,000 Bitcoins for two pizzas! Its whitepaper had been released earlier in 2008. According to Nakamoto, it would allow "online payments to be sent directly from one party to another without going through a financial institution". Thus Bitcoin was set up to be a major disruptor of the centralized and organized Financial system.

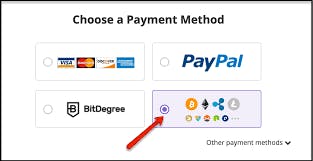

So how does Bitcoin handle transactions? To use Bitcoin or any other Cryptocurrency for payment, you would need a wallet, a popular one being Metamask which can be used on a browser.Wallets hold the private keys to the bitcoin you own, which need to be entered when you're conducting a transaction. An online business can easily accept Bitcoin by adding this payment option to its other online payment options: credit cards, PayPal, etc. It would be safe to mention here that Bitcoin transactions are not the fastest in the industry as major payment systems such as Visa and Paypal on the average takes less time to complete.

Bitcoin currently sells at around $16,846(from a high of more than $60,000 a year ago). Its market cap is $323.53bn, the highest in the industry.

- Litecoin(LTC) - LTC was designed to provide fast, secure and low-cost payments based on the Bitcoin protocol. However, it has different properties of which results in low transaction fees, making it suitable for micro-transactions and point-of-sale payments. Litecoin was released via open-source client on GitHub on October 7, 2011 and the network went live five days later. Since then, it has boomed in both usage and wide merchants' acceptance and has also emerged as the top ten cryptos by market capitalization. As at today, LTC sells at $59.38 and has a market cap of $4.25bn.

So why should we consider Litecoin? Litecoin is said to be the second most popular pure cryptocurrency. As at January 2021, it is one of the most widely accepted cryptocurrencies, and more than 2000 merchants and stores now accept LTC across the globe.

In terms of security, Litecoin is secured by incredible strong cryptographic defences - making it practically impossible to crack.

So why should we consider Litecoin? Litecoin is said to be the second most popular pure cryptocurrency. As at January 2021, it is one of the most widely accepted cryptocurrencies, and more than 2000 merchants and stores now accept LTC across the globe.

In terms of security, Litecoin is secured by incredible strong cryptographic defences - making it practically impossible to crack.

- Ripples(XRP) - The XRP Ledger(XRPL) was launched in 2021 and has among its numerous benefits low-cost of transaction($0.0002 to transact), speed(settling transactions in 3-5 seconds), scalability(1500 transactions per second) and energy efficiency. Apart from its use as a payment enabler, the XRP Ledger is used in tokenization, DeFi, and stablecoins.

There are currently 80 billion XRP today in circulation and has a market cap of $18.44bn. It also trades at around $0.3672 as at today(Nov 12, 2022).

There are many other crypto currencies out there that are useful for payment solutions and these include Ethereum(ETH), Bitcoin Cash(BCH), USD Coin(USDC), Paxos Standard(PAX). As a general rule, they are all fast, scalable and decentralized. The downside however remains their volatility. As mentioned in the opener, all the currencies are bleeding at the moment due to the collapse of the FTX exchange and this will no doubt affect investors' confidence. Notwithstanding, they have come to stay and it is hoping that all the unhealthy pressures around them will ease out with time.

Next week, I will look at another category of Cryptocurrencies as an application. Ethereum is today involved in the explosion of Dapps(Decentralized Applications). What are the key points? Let's keep it day then.